Expert Financial Solutions for Your Business

Tax Planning

Business Advisory

Audit & Assurance

Your Trusted Chartered Accountants

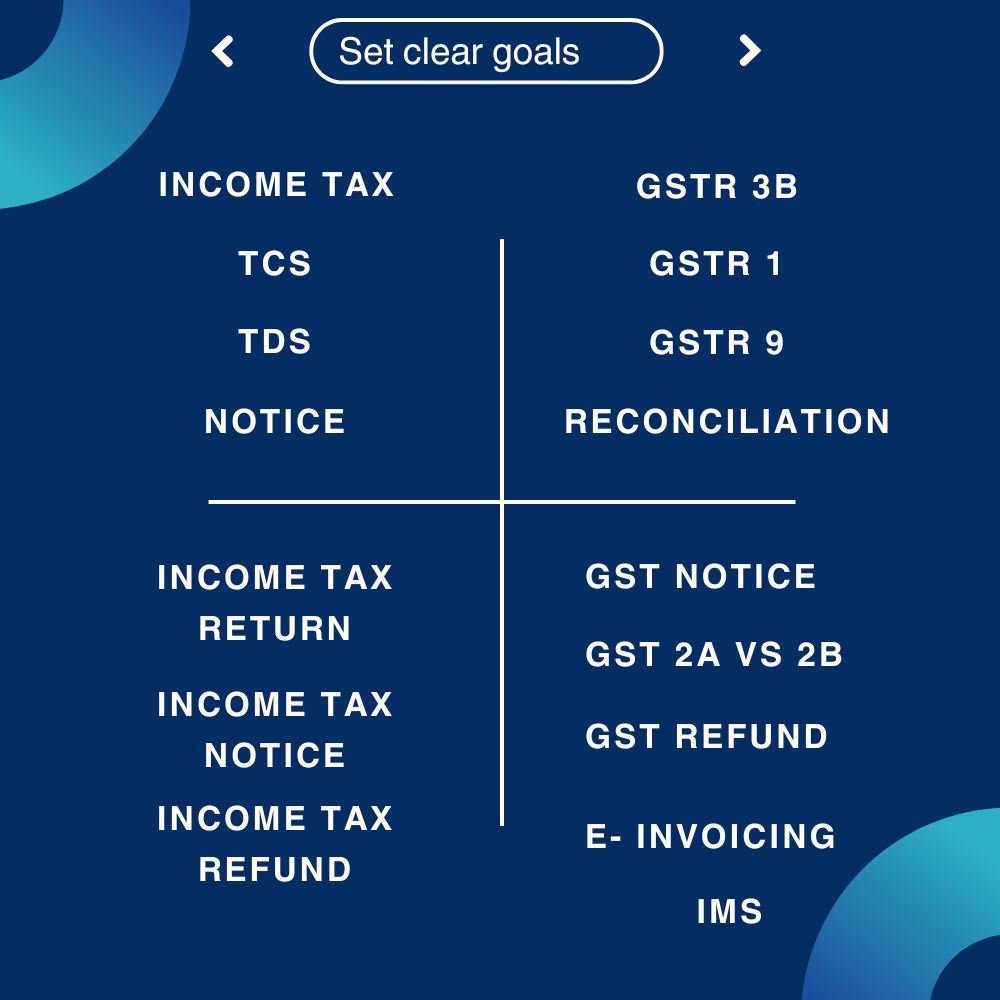

Income Tax

Companies Act

GST

About Us

Why You Should Trust Us? Get to Know About Us!

J P Parmar and Company believes in delivering expert financial solutions with integrity, transparency, and professionalism. With years of experience in taxation, auditing, and business advisory, we are committed to helping businesses grow, comply, and succeed in today’s competitive world.

Client-Centric Approach

✅Expert Chartered Accountants

✅ Comprehensive Services

✅Ethical & Transparent

✅Technology-Driven Solutions

Read MoreServices

Financial & Business Solutions

Latest Blogs

Our Insights & Updates

Changes in ITR - 4 - F.Y 2024-25 ( A.Y 2025-26 )

Published on: 11 Jun 2025The Finance Act 2024 has introduced several important changes that impact ITR-4 (Sugam) for the Assessment Year (AY) ...

Changes in ITR - 1 - F.Y 2024-25 ( A.Y 2025-26 )

Published on: 11 Jun 2025The Finance Act 2024 introduced several updates to ITR-1 (Sahaj) for the Assessment Year 2025-26. Here are the key ch...

What are Virtual Digital Assets (VDA)?

Published on: 07 Jun 2025The concept of Virtual Digital Assets (VDAs) and their taxation was formally introduced in India's Income Tax Act, 19...

Significant changes to Section 12AB of the Income Tax Act, 1961

Published on: 07 Jun 2025The Finance Act, 2025 has brought about significant changes to Section 12AB of the Income Tax Act, 1961, primarily ai...

About Section 194T of Income Tax Act,1961

Published on: 07 Jun 2025Section 194T is a significant new provision introduced in the Income Tax Act, 1961, by the Finance Act, 2024 (which b...